Discover

Our publications

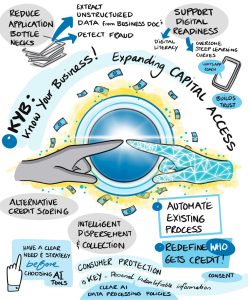

Insight Brief: Using AI to Unlock Access to Small Business Finance

Discover how AI-driven onboarding platforms can rapidly expand services to small business customers and unlock financing opportunities for millions of entrepreneurs.

Watch Filipino Entrepreneurs ‘Unboxing’ Chat-based Financial Services

Watch three entrepreneurs interact with Boost’s simple, seamless progressive profile development UI deployed in three real-world examples for Philippines banks

With Boost+Oradian, RAFI Microfinance fully digitizes its customer journey using chat-based onboarding

Check out the off-the-shelf option to integrate Boost’s Progressive Profile Development digital onboarding with your Instafin core banking System, with a real-world example from RAFI

New Feature Release: The Power of Your Data Dashboard

See how a Boost client bank grew its applicant pool by 30% instantly because of a data insight, and how you too can utilize your data dashboard for growth

Boost Capital lands US$2.5M for its chat-based bank client onboarding platform

Boost Capital secures US$2.5 in seed funding from Village Global, Iterative Ventures, Hustle Fund, Epic Angels, Xcel Next, Insitor and prominent agels

Village Global invests in Boost Capital

As Village Global’s latest investment, Boost Capital is pleased to be joining Village’s network of amazing entrepreneurs.

Epic Angels joins Boost Capital investors

Powerhouse network of angel investors, Epic Angels, joins in investing in Boost Capital

Press about Boost Capital

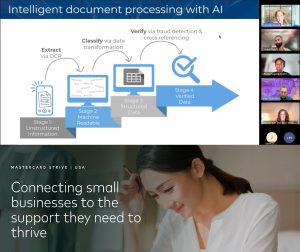

Financial Inclusion Week 2025: AI Solutions in SME Financing

Tune in to Boost’s Lucinda Revell, Mastercard Strive's Shuba Chandran and RAFI Microfinance's Tom Kocsis Financial Inclusion Week panel exploring AI Solutions in SME Financing: transforming digital onboarding with AI-powered KYC/KYB and income validation

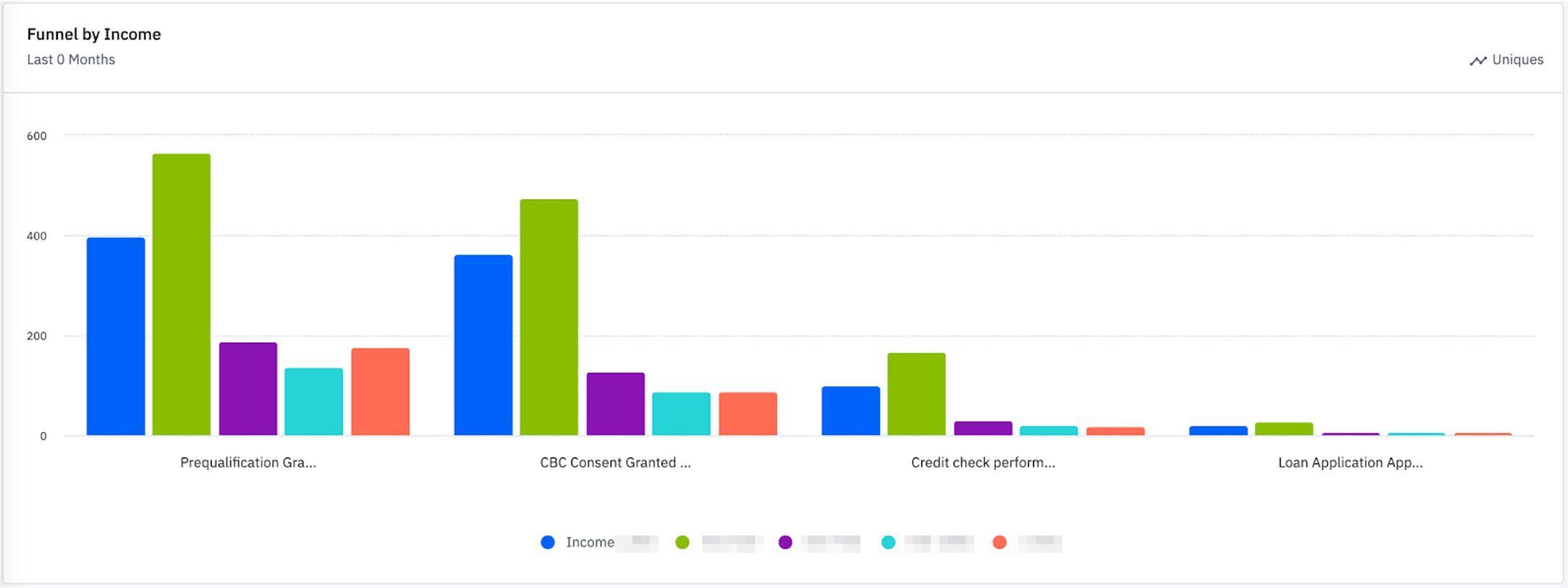

A/B Testing Drives Growth & Better UX in Digital Financial Services

Boost's real-world insights on optimizing onboarding funnels for small business lending

Mastercard Strive “Beyond the USA” Panel: Boost’s Southeast Asia Innovations

Boost reveals how chat-based onboarding and AI-driven document verification improve loan access & customer experience for small businesses in the Philippines and Cambodia.

Mastercard Strive asked Boost about how we use AI to enable digital applications for small businesses...

... So we laid out what has and hasn't worked when it comes to AI-deployment in emerging markets.

The partnership of Mastercard Strive & Boost exceeds its initial partner targets by five times!

Among the 15 financial service providers, adopters include Asialink, Paymongo, UNO Digital Bank, RAFI Microfinance & Cantilan Bank. Together, they serve over 25 million Filipino clients.

Financial Alliance For Women Panel on "Fintechs Financing WMSMEs"

Boost co-founder Lucinda Revell on removing the impediments that prevent the Financial Service Providers from adopting solutions that best meet the needs of entrepreneurs

PayMongo launches Boost tech to simplify merchant onboarding

Boost tech now deployed for Paymongo, a leading Filipino fintech for enabling payment processing, business wallets, and flexible capital solutions for SMEs

Brankas and Boost Capital Announce Partnership

Transforming the Lending Landscape in Southeast Asia with API-Powered, Chat-Based Loans

United Nations ESCAP's interview with Boost Capital's Head of Product

Fostering economic growth "through tailored solutions and digital platforms... empowering entrepreneurs to achieve their dreams"

Women's World Banking panel featuring Boost tech demo

Representatives from Brankas, Boost, Wing Bank, Musoni and Advans Group provided stellar insights into how to leverage digital tools to make customer onboarding as smooth and intuitive as possible.

Boost Capital on Improving Financial Inclusion and Financial Education

Head of Product, Porhour Ly, speaks at the ILO's Social Finance Programme/University of Liverpool's Social Finance Symposium

Mastercard and Boost Capital partner in the Philippines

The Mastercard Center for Inclusive Growth partners with Boost to accelerate adoption of new client onboarding channels in the Philippines

Rising Giants podcast Interview

Listen in to the latest podcast from Rising Giants as they interview Boost Capital founder Lucinda Revell. They discuss people who have inspired her, and what has worked and not worked for her as an entrepreneur. Enjoy!

Financial Alliance For Women Panel

Watch Boost's Gordon Peters speak about how Boost uses A.I. for customer service and onboarding during FAW's panel on how A.I. can improve women’s financial inclusion

Interview with an Innovator

Glenn Powell, the first engineering hire at OpenAI, on the future of artificial intelligence, early days challenges at OpenAI/early versions of ChatGPT, & his children's exposure to AI

Product Manager Porhour Ly presented to the United Nations ESCAP & National Bank of Cambodia Study Tour group

Por presented on designing digital financial literacy products to enhance women's access and usage

Boost Co-Founder Lucinda Revell Advises Cambodian entrepreneurs

Boost Capital gives back by advising CJCC Accelerator Program entrepreneurs on how to pitch their Cambodia-based startups for international partnership and investment.

Boost Capital takes Silver in the Financial Alliance for Women’s hackathon

Boost presented our solution for the problem of Financing Women-Owned/Led Businesses: Banks can use Boost’s unique chat-based loan and savings onboarding to expand access to finance for female entrepreneurs.

Cambodia-based journal, Kiripost, interviews Boost co-Founder Gordon Peters About our Chat-based tech and Recent Investment Round

Boost Capital Raises $2.5M to Accelerate Growth and Transform Digital Banking

Cambodia based Journal, Kiripost, interviews Boost co-founder Lucinda Revell

Cambodia Fintech Company Elevating Access to Finance