Financial institutions have been rapidly deploying Boost’s chat-based onboarding technology to expand access to finance to small businesses throughout the Philippines. Rather than waiting in line at a bank branch to fill out an application, Boost’s approach to onboarding means small businesses can apply for loans, savings accounts, payments solutions, and financial literacy training all through chat-based platforms they are already familiar with.

To better capture our simple and seamless approach, we interviewed three entrepreneurs in real-time as they tried out our technology to apply for loans from three Filipino banks using Boost’s chat-onboarding tech: RAFI, Cantilan Bank, and Quezon Capital. These entrepreneurs, who each felt comfortable using social media but were not frequent users of digital financial services, reacted to key features of the chat-based onboarding process:

- Ease of starting a chat, especially compared to downloading new bank apps

- Receiving a prequalified loan offer before having to provide personal information

- Strong security features

- Identity confirmation that was easy and efficient

- Providing supporting documents that were quickly approved

- Receiving nudges and being able to pause an application

Check out their unboxing experience:

Overall, the entrepreneurs found Boost’s chat-onboarding easy to navigate, and felt there was clear guidance throughout the process.

In talking with the entrepreneurs, they also highlighted some of their anxieties, which they felt like the technology succeeded in addressing:

- Typically, banks take a long time to respond and approve loan applications, creating anxiety. The entrepreneurs gave positive feedback based on the chat application process being fast and simple, with instant responses.

- They worried about making a mistake during the new experience of a digital application. With Boost, they reported it was easy to correct answers easily.

- They don’t like providing lots of personal upfront information before understanding if a loan fits their needs, so receiving a prequalified loan offer within 5 minutes of starting a chat (before providing personally identifiable information), was really popular.

But there’s always room to improve, and through this unboxing process, we also got feedback on some opportunities for improvement:

- Trust concerns are a major barrier in the Philippines, and there is a high awareness about digital scams. Users sometimes hesitate to engage with digital solutions due to fears of scams. Boost’s white-labeled solution means branding and product configurations are tailored to each bank, staying consistent with the bank’s brand persona and clearly embedded into the chat channels owned and operated by the bank itself. While clear branding and knowing upfront that the chat-based applications were officially operated by the bank helped ease these concerns, they didn’t fully eliminate them, since digital impersonations have become quite sophisticated. To build trust, consistency is key: not only does the chat experience have to reassure the customer that their data is protected with rigorous security protocols, the bank’s advertising and the other digital collateral (such as their Facebook Page, Instagram account, TikTok account, and website) all need to collaborate to build trust in the digital onboarding experience.

- Digital links: Trust issues are particularly important in relation to digital links. Customers rarely share links, and small business owners often don’t trust receiving them because of the prevalence of scams. Ads promoting digital onboarding need button-based Call-to-Actions that cannot be intercepted/manipulated, rather than text URLs. For example, check out how it displays for customers in RAFI’s Facebook Ad as an “Apply Now” button:

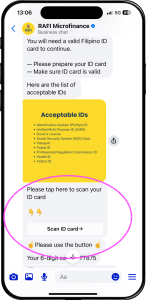

The same is true for the web applications Boost uses to perform facial recognition to match applicants with their ID cards, to run liveness detection to make sure they’re a real person, and to collect their supporting documents, among other uses. Boost’s tech seamlessly weaves these features into chat-based onboarding, but it’s crucial that they be offered to the applicant as button-based Call-to-Actions rather than a text URL. Check out how it displays for a customer in RAFI’s Messenger chat as a “Scan ID Card” button:

At Boost, we believe talking to the customers (the end-users of Boost chat-onboarding tech) is a critical step to creating the best user interface for financial service onboarding. By talking with customers, we get to understand their pain points as entrepreneurs, and how we can upgrade our tech to address them, while also bringing joy and convenience to the experience. Customer interviews, like those captured in this unboxing video, help shape our product, making it more relevant to small businesses. And stay tuned for our next blog post on another crucial tool in our user design toolbox: A/B testing!

0 Comments