How AI-enabled financial service onboarding platforms can expand your small business customer base and extend access to finance for millions of entrepreneurs.

Boost’s AI-powered tech helps financial institutions onboard customers faster and smarter within natural chat experiences, delivering a no-barrier application flow that validates customers and businesses seamlessly across all smartphones.

Mastercard Strive is a portfolio of philanthropic programs supported by the Mastercard Center for Inclusive Growth and funded by the Mastercard Impact Fund. From 2021 through 2024, Mastercard Strive reached 19 million small businesses across more than 30 countries, helping them go digital, get capital, and access networks and know-how.

This brief was compiled by Lucinda Revell, co-founder of Boost Capital. She’s a fintech entrepreneur who empowers financial institutions to expand customer reach and enrich customer files with AI-driven tech seamlessly integrated into existing systems. Boost Capital has partnered with Mastercard Strive to support the digitalization of Filipino and Cambodian small businesses.

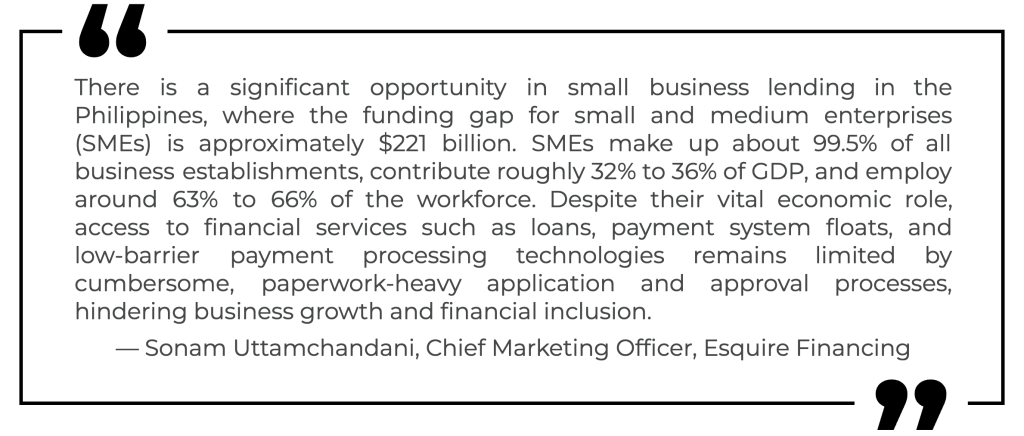

Whether you’re a financial institution with a mandate to lend, take deposits, process payments, facilitate merchant cash advances, offer insurance, or a multitude of ancillary financial services, we bet you’ve looked into both the massive untapped opportunity of serving small businesses, and the significant challenges in doing so.

Financial service providers (FSPs) can supercharge customer acquisition and approval by leveraging AI in multiple ways:

- To power unstructured chatbots that make financial services more accessible for small businesses (apply anytime, from anywhere, just like chatting with a friend)

- For natural language processing (NLP) to allow entrepreneurs to chat in everyday language

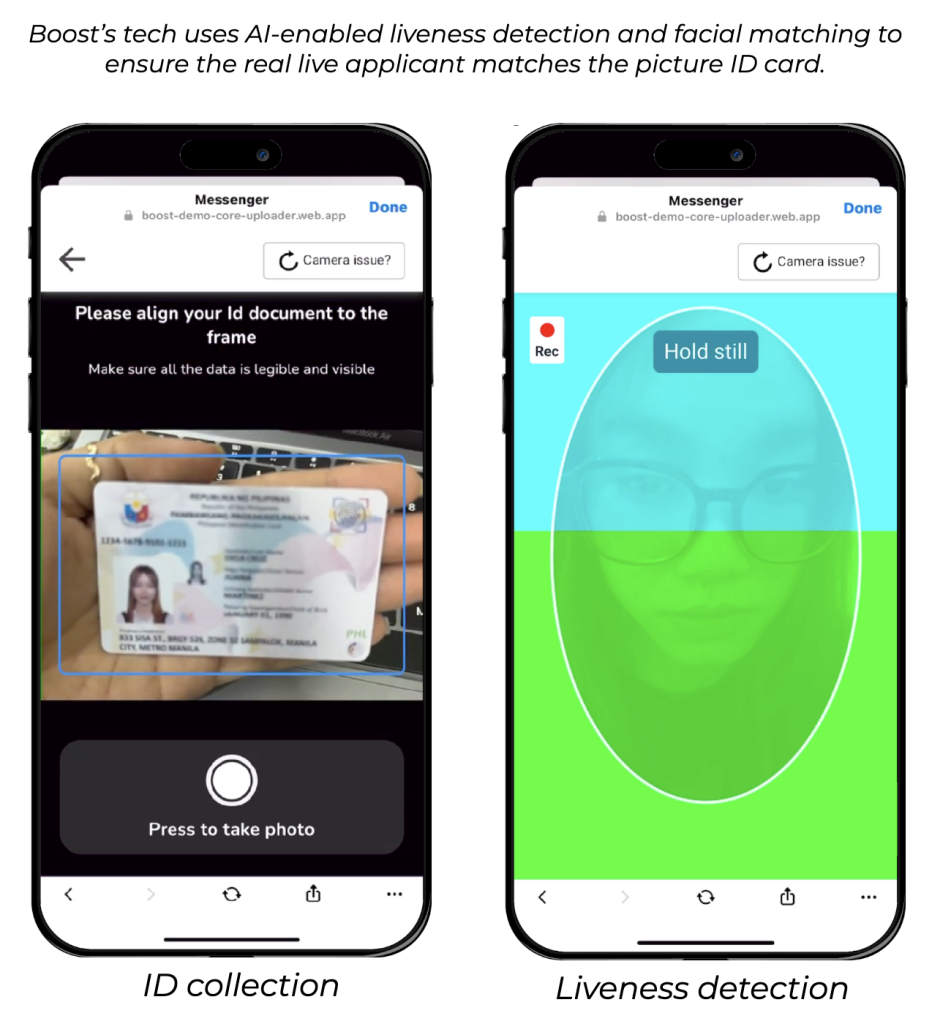

- For facial recognition and liveness detection to protect both applicants and FSPs from fraudulent applications

- For ID and document interpretation using optical character recognition (OCR) to save applicants time (Just snap a pic! Don’t waste time transcribing info!)

- For ID and document fraud detection to provide verified info to FSP so they can confidently serve digital applications

- To power credit underwriting copilot systems to optimize underwriting officers vetting and approval processes

Adding AI to front-end and back-end processes can enable faster, more accurate, and scalable access to financial services for a huge small business customer base. This insight brief examines how FSPs can utilize AI to expand their small business customer base without compromising customer quality.

How AI reduces barriers for FSPs wanting to expand their small business customer base

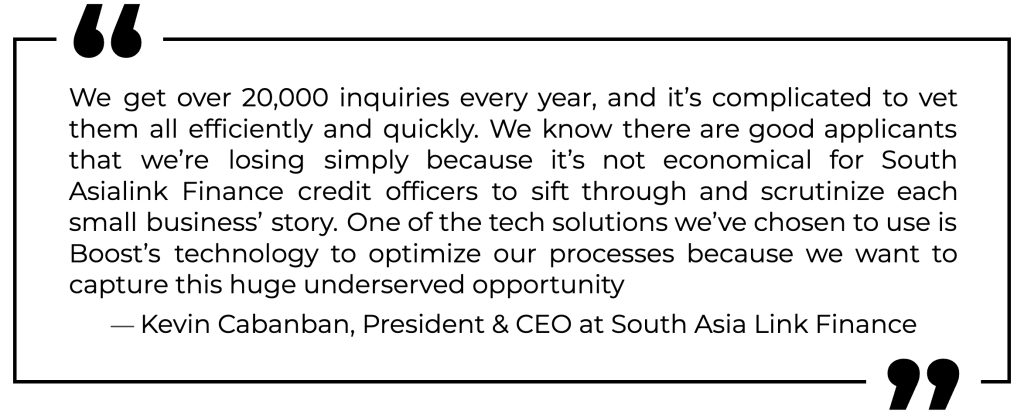

Boost Capital works with FSPs that have carefully developed their credit underwriting criteria to minimize loan defaults or dormant savings accounts. This hard-won wisdom must play a crucial role in expanding financing for small businesses to ensure the sustainability of FSPs. Thus, the focus on expanding a customer base using AI is done without sacrificing thorough underwriting processes. This is where Boost Capital has learned that AI can deliver clear efficiencies for FSPs.

About the Boost Capital and Mastercard Strive partnership

In June 2024, Mastercard Strive and Boost Capital partnered to enable access to digital financial services, with a focus on women-led enterprises, in the Philippines and Cambodia. Boost Capital enables FSPs to serve customers via popular chat platforms such as Facebook Messenger, Telegram, and WhatsApp, without downloading another app.

The program exceeded its initial aim to empower 10,000 small businesses: over 56,000 Filipino and Cambodian entrepreneurs interacted with the chat-based loan and savings account applications powered by Boost’s white-labeled technology. Almost 6,000 completed the thorough yet convenient digital applications offered through Facebook Messenger by each of Boost’s banking or payment gateway partners. Further, Boost Capital expected to recruit between 3 and 5 FSPs from across the financial landscape, but signed on 20 FSPs, signaling a strong desire for FSPs to support Filipino and Cambodian small businesses with greater access to digital financial services to improve their financial health and accelerate the growth of their businesses.

Understanding FSP requirements

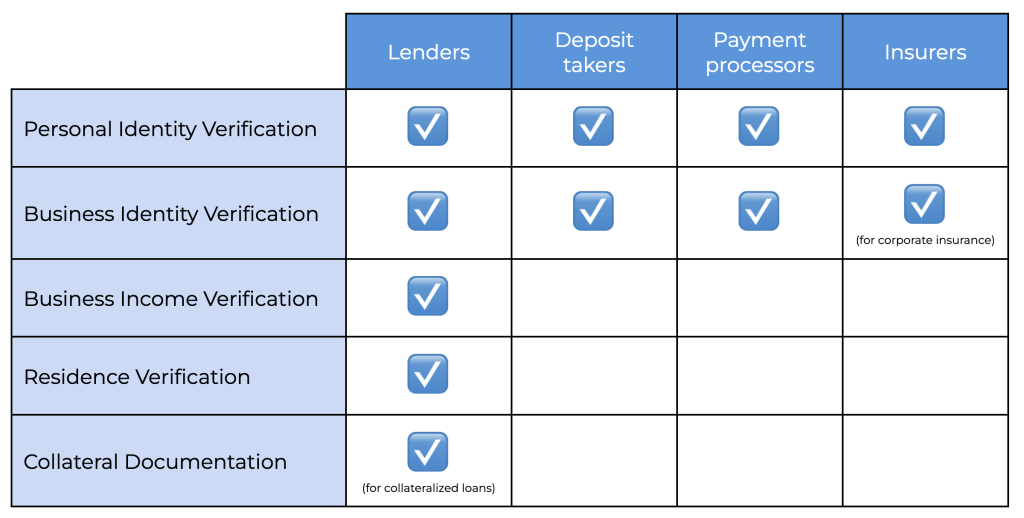

Whether commercial bank, microfinance institution, payment gateway, e-wallet, or insurance company, all FSPs must verify a few key factors about a merchant seeking a financial service before they can turn that lead into an active customer:

1. Personal Identity Verification: Who is the customer? Who is the bank financing? Who’s using the e-wallet? Who’s getting insured? FSPs need to know if a person is legitimate, and if they have a history of illegitimate activity. This is required under Know Your Customer (KYC) and anti-money laundering (AML) requirements that regulators impose on FSPs around the world.

- Verification evidence includes photo ID, selfies (to match against photo IDs), and marriage contracts.

- Capturing a selfie as part of a video/image stream interaction and applying AI to check for “liveness” to ensure it’s not a fake, video, or mask.

2. Business Identity Verification: What business is this? For entrepreneurs, this means explaining who they are and what their business is. FSPs need to know what business they’re financing, and whether it is legitimate, as required under Know Your Business (KYB) requirements (a banker’s dry wordplay on KYC).

- Verification evidence includes a business registration permit, a tax registration certificate, a business attestation letter issued by a local official. For corporations/partnerships, more formal documentation can be required, including Articles of Incorporation/Partnership, Board Resolution/Secretary Certificate, by-laws, etc.

3. Business Income Verification: Is the business going to be a good customer? Will it repay a loan, or utilize its savings account / e-wallet / payment processes on an ongoing basis? For an FSP, if the business cannot afford the financing or the service, it’s not a sustainable customer.

- Verification evidence includes photos of the business or a video tour, invoices/receipts, inventory list/photos, trade references from suppliers/customers, and more.

4. Residence Verification: Where can an FSP find this business and the people responsible for it, in case of a default or a legal problem?

- Verification evidence includes a utility bill, a lease contract/house title, or a residency attestation letter issued by a local official.

5. Collateral Documentation: What collateral is being used to secure the financing (in the case of collateralized lending)? If the borrower is pledging collateral to secure financing, the FSP needs to ascertain the value and verity of that collateral.

- Verification evidence includes a title document, a tax declaration, etc.

Verification requirements vary depending on the financial service sector. For additional detail on what types of documents are required in the context of the Philippines, please see the appendix.

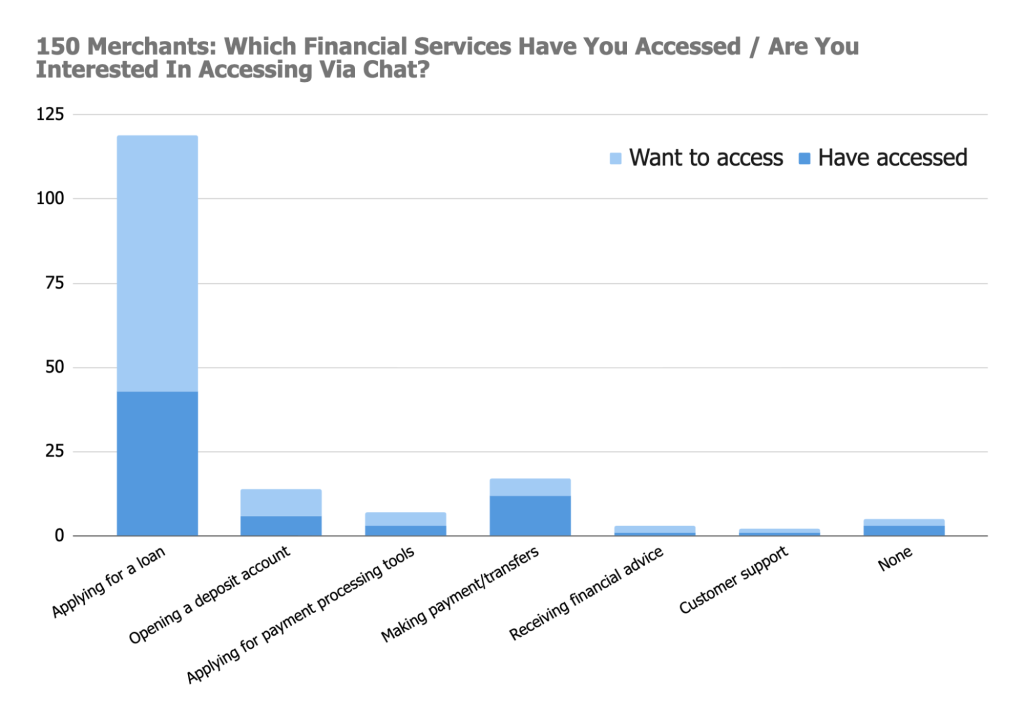

Although Boost Capital’s technology works across financial service sectors, by far the highest-demand service from small businesses and entrepreneurs is borrowing. A recent Boost Capital survey of 150 Filipino merchants found that access to loans dominated their motivation to use a digital application.

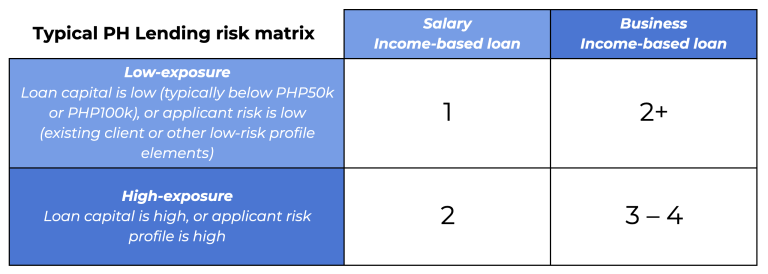

We typically find that lenders vary verification requirements depending on the income type of the applicant and the bank’s exposure level. If 1 represents lowest risk and 4 highest risk, with granular qualifiers like 2- and 2+, on average, FSPs would put the most verification scrutiny on higher-risk profiles. Using an example from the Philippines, lenders on average would rate risk as:

For a high-exposure loan to a business-income applicant, the loan type necessitating the highest level of security, the FSP will have an order of priority for the verifications it must do to vet the application. The FSP will seek first to address the high-impact issues that also don’t cost a lot to carry out (low Operating Expense, or low OpEx for short), and continue from there:

- Personal Identity Verification is (relatively) easy to do and is considered high-impact. If there is identity fraud, the FSP should not proceed with the application process (low OpEx, high impact).

- Business Identity Verification can be done fairly easily (low OpEx, high impact) in jurisdictions with standardized and prevalent business registration documentation, though unregistered businesses are of course the exception. In jurisdictions lacking standardized or commonly used documentation, FSPs have to bear higher OpEx spending time verifying business identity through less easily processed documents, such as attestation letters from a local authority.

- Business Income Verification is more difficult, especially with informal businesses. It requires examination of accounting documents (if available), contracts, invoices, trade references, or inventory. The higher OpEx requirement of this verification means it’s typically put off until later in the vetting process, and/or requires FSPs to pass on the OpEx to the borrower, making the processing fee on small business loans relatively high compared to the limited size of the loan on offer.

- Residence Verification is fairly easy to do, but FSPs consider it to be low impact, as it’s not a key exclusion criteria. Rather, it’s a check that’s done once the FSP is fairly certain to be issuing a loan.

- Collateral Documentation (if it’s a collateralized loan) is also difficult (high OpEx), so lenders put it off until the end of the process. It requires examining ownership documentation and establishing a plausible value of the asset. But collateral documentation is also high impact because it allows the FSP to offer larger loans, as the security of the collateral offsets the additional risk of a large loan exposure.

Challenges with document verification

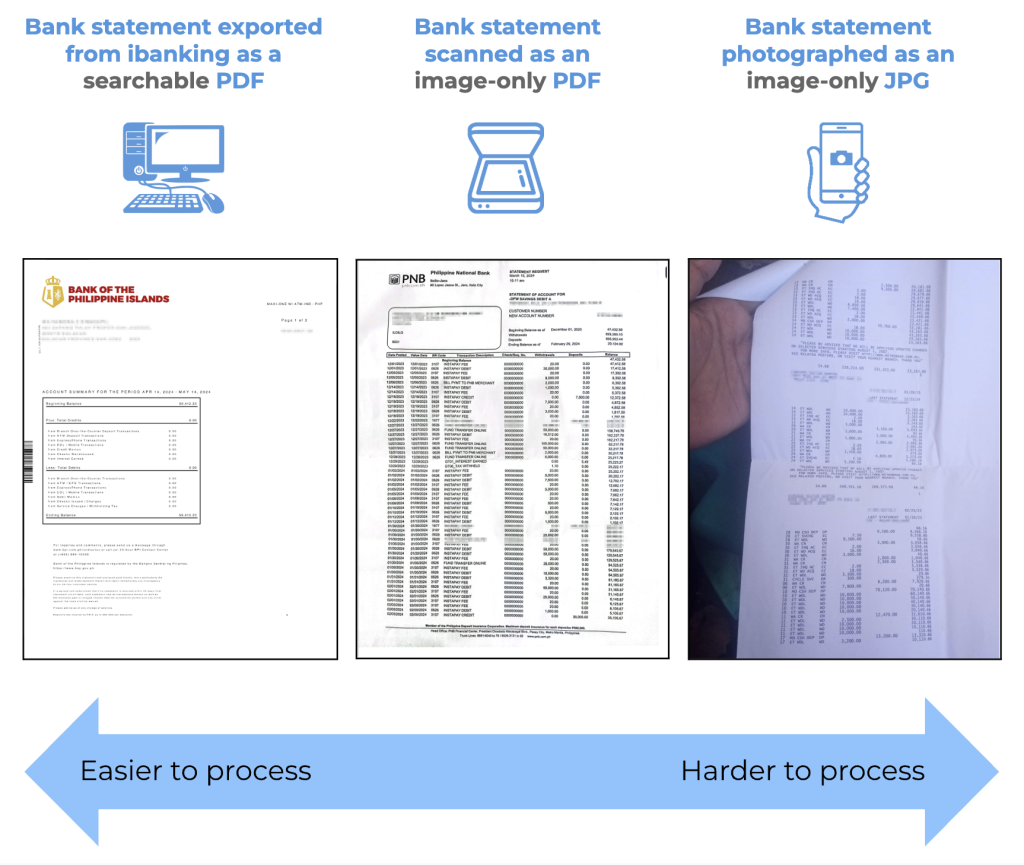

Throughout this process, FSPs collect verification documents from applicants. In the past, applicants would bring original documents into a bank branch for examination, where they were often photocopied and added to a folder. Nowadays, applicants can directly upload documents via online portal and apps or through chat, like Boost Capital enables.

In some cases, direct upload is possible, and applicants can submit PDFs that have a high-image quality and are “searchable,” meaning a computer can tell the difference between each word in the PDF. However, the majority of applicants still submit “image-only” document types (e.g., PDF, JPG, PNG). This is the modern version of the bank photocopying an original and filing it in a folder.

In the Philippines, Boost Capital found that just 10% of documents submitted by small businesses as part of digital lending applications are searchable PDFs. The vast majority—90%—are “image-only” files, usually submitted by taking photographs of hard-copy documents or screenshots from banking apps. Larger businesses submit 17% searchable PDFs and 83% image-only files, as they tend to have electronic record systems that allow for direct PDF export. Either way, the proportion of searchable PDFs remains relatively low.

For image-only documents to be usable, FSPs need to further process them. Without a tech solution, FSP staff manually enter data from the document into their client management systems, which can take time. Most FSPs can’t afford to spend significant time on data entry, so instead of digitizing full documents, they usually enter only key data points. For example, FSP staff might review the summary page of a bank statement and quickly scan transaction details on subsequent pages for red flags. Consequently, fraudulent transactions can slip through the review process. This also means FSP’s digital records remain sparse, impeding robust analytics (whether traditional, or powered by machine learning and AI) that could improve underwriting and product development to expand access to finance to new customer bases.

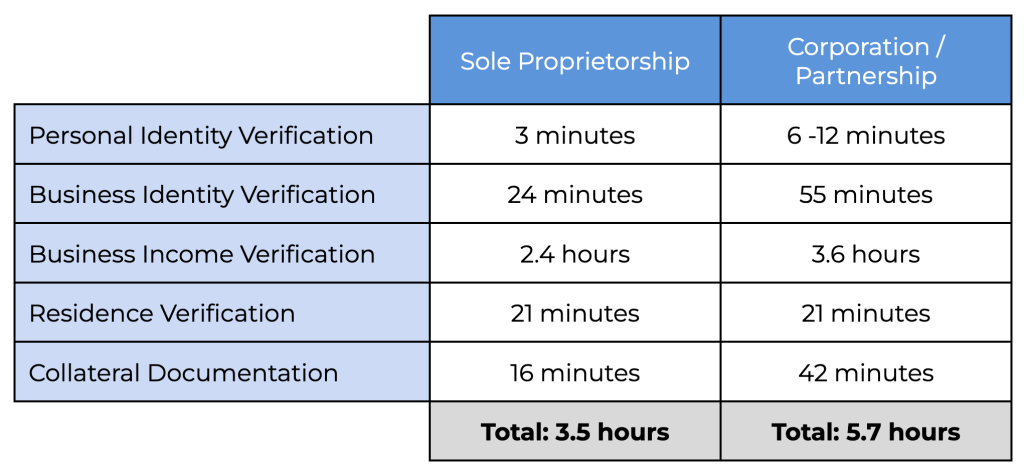

If an FSP wanted to process a full document, how much time would it take? Boost Capital analyzed data from our Philippines operations on how long it takes for a highly trained data entry team at an FSP to manually enter data to support document verification.

The AI opportunity

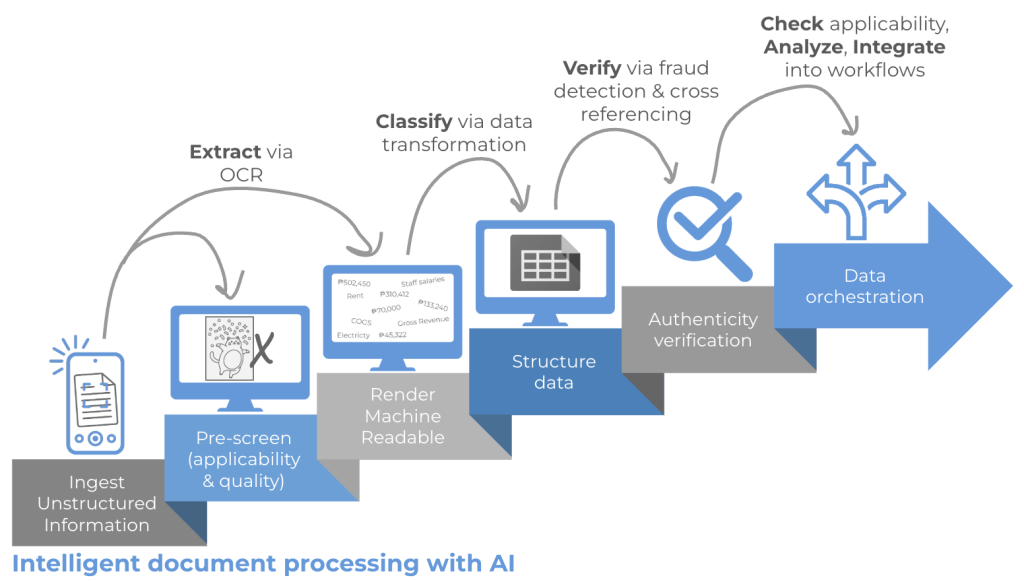

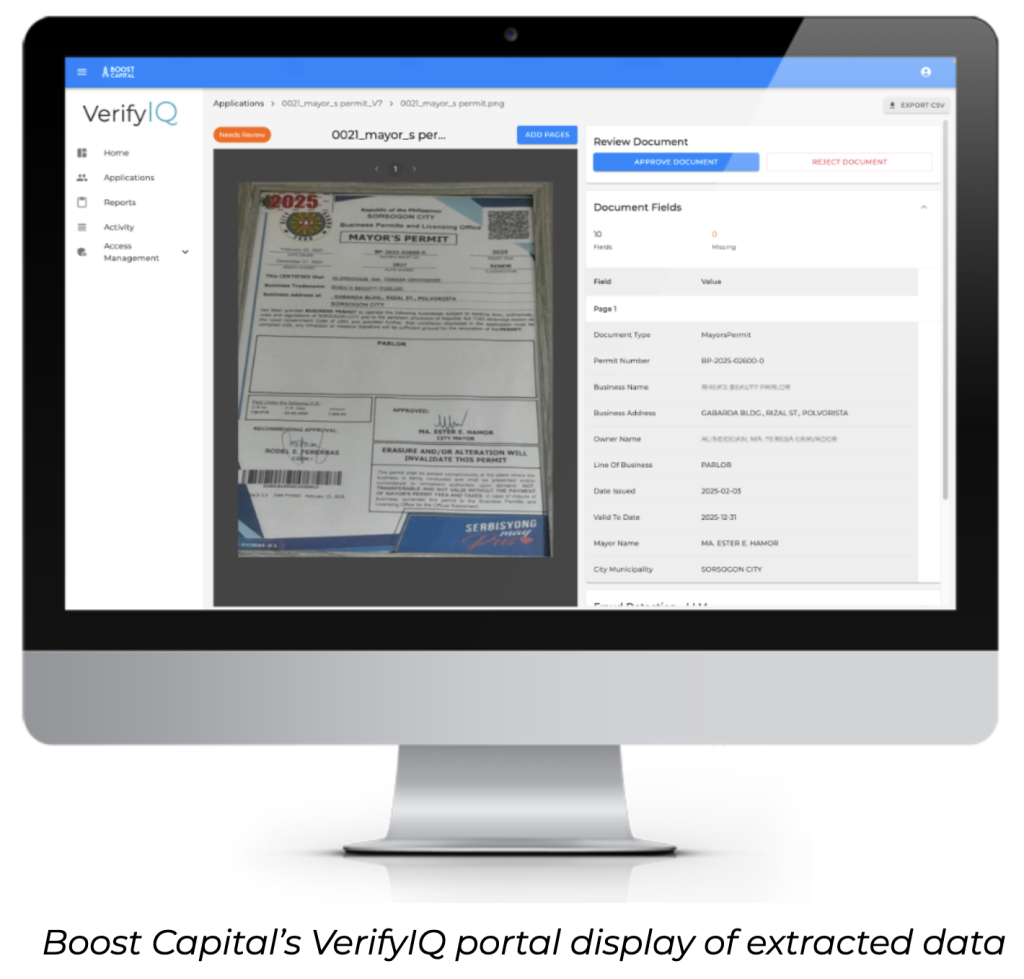

Saving time and developing more robust analytics are two ways AI is supercharging the verification process for FSPs. For example, Optical Character Recognition (OCR) is low-hanging fruit for AI. FSPs can use OCR technology to extract data from an image-only file, eliminating the need for manual entry by taking unstructured inputs (image files) and rendering them into machine-readable data.

But machine-readable data on its own isn’t very useful for FSPs. Take, for example, the information “Juan Dela Cruz,” that OCR technology extracts from a bank statement. What makes the data useful is identifying that the data point is an applicant’s name. Here, AI can also render machine-readable data into structured outputs by associating the data with category fields. “Juan Dela Cruz” is classified as a name field without a human having to make that judgment call.

Using AI to process unstructured documents into structured data can save FSPs a lot of time. But if the data isn’t verified, its usefulness remains limited. AI can also assist in detecting fraud within documents. Boost Capital has already written about how we use AI to spot digital manipulation. In addition to detecting fraud, we also use AI for logical checks. Within one document, we can do math checks (for example, determining whether balances on a bank statement add up). Across an applicant’s documents, we can apply math checks (e.g., whether bank statement credits match business invoices) and other logic checks (e.g., whether the business’s name matches across documents). AI enables us to apply fraud detection across an applicant’s entire file, not just one document within it.

By combining these AI agents, we’re able to process unstructured business documents into verified, structured data, enabling FSPs to automate and expand their application processes. With more data now available to backend systems, FSPs’ approval process and data analytics have been supercharged.

AI agents can also support FSPs in other ways that can expand their small business customer bases. AI can analyze customer applications to complete compliance checks, calculate risk scores, and make underwriting recommendations. AI agents can act as “credit copilots” to credit officers. Credit officers receive pre-processed files with key factors flagged for human review, significantly increasing their productivity without sacrificing on vetting quality.

How do entrepreneurs feel about interacting with AI?

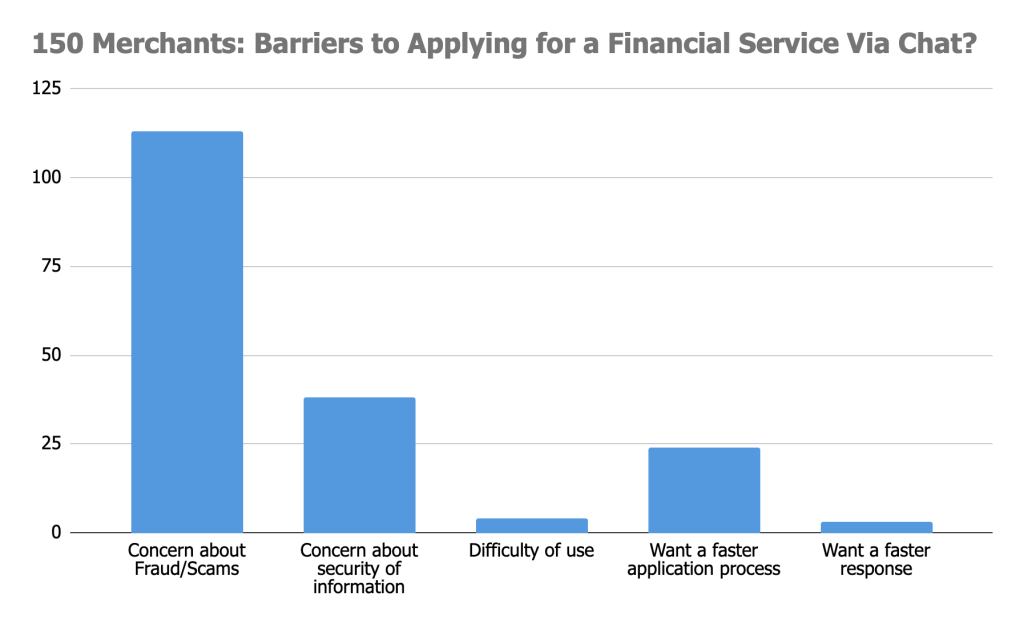

As we integrate AI solutions into financial service delivery, we must also take into account how small business applicants perceive these solutions, in contrast to the human interactions users are accustomed to when visiting a bank branch or chatting with a live customer service agent.

With AI-enabled digital applications, merchants need to share information about themselves and their businesses. If they don’t feel comfortable with this process, they won’t do it. One approach is to keep the use of AI only on the backend, such as with document processing, so it does not interface with customers, like with AI-powered chatbots/telephony that replace live agent interactions. But even then, buried in the terms and conditions that customers need to consent to is often a clause requiring customers to agree their data can be processed by third-party systems. It’s highly likely that as AI-powered data processing becomes increasingly prevalent, these clauses will be expanded to specifically reference large language model access to data.

In a survey of merchants in the Philippines, Boost Capital found that concerns about the security of information is one of the greatest barriers to applying for a financial service digitally. The World Economic Forum’s ASEAN Digital Generation Report on digital financial inclusion shows this is a widespread regional trend. Thus, ensuring that merchants feel comfortable sharing their data digitally, especially with AI-powered systems, is key to adoption of digital tools for accessing financial services.

Engaging with small business customers through our FSP partners has identified some ways these barriers can be addressed to make small businesses more comfortable with AI-enabled digital applications. Boost Capital has found that clearly and simply explaining to customers that information is always encrypted, securely stored, and not used for spam improves submission rates (see our blog).

Looking ahead

The success of Boost Capital’s partnership with Mastercard Strive highlights the transformative power of AI-driven digital onboarding in expanding financial access for small businesses. By mid-2026, Boost Capital expects to have 20 FSP partners in the Philippines and Cambodia launched and over 200,000 small businesses supported. Harnessing AI to streamline identity verification, document validation, and fraud detection enables FSPs to significantly reduce operational costs while maintaining rigorous underwriting standards. This not only accelerates credit inclusion for entrepreneurs, but also enhances the quality and sustainability of lending portfolios. As digital channels gain trust among users, clearly communicating data security and privacy protections further encourages adoption. The experience of Boost Capital demonstrates that thoughtfully integrated AI solutions can break traditional barriers, empowering underserved small businesses to thrive in today’s digital economy.